Unlock Seamless IDR Payout Solutions

All-in-One

All-in-One IDR Payout Platform

for Businesses

Deliver secure and compliant B2B payout services for salaries, procurement payments, and in-game credit withdrawals — all with seamless integration and high efficiency.

Powerful Features for Every Business

Deliver secure and compliant IDR payouts across Indonesia — covering payroll, vendor payments, and in-game credit withdrawals — with simple APIs and real-time tracking.

- Multi-Scenario Payouts (payroll, vendors, in-game withdrawals)

- Real-Time Processing with live status tracking

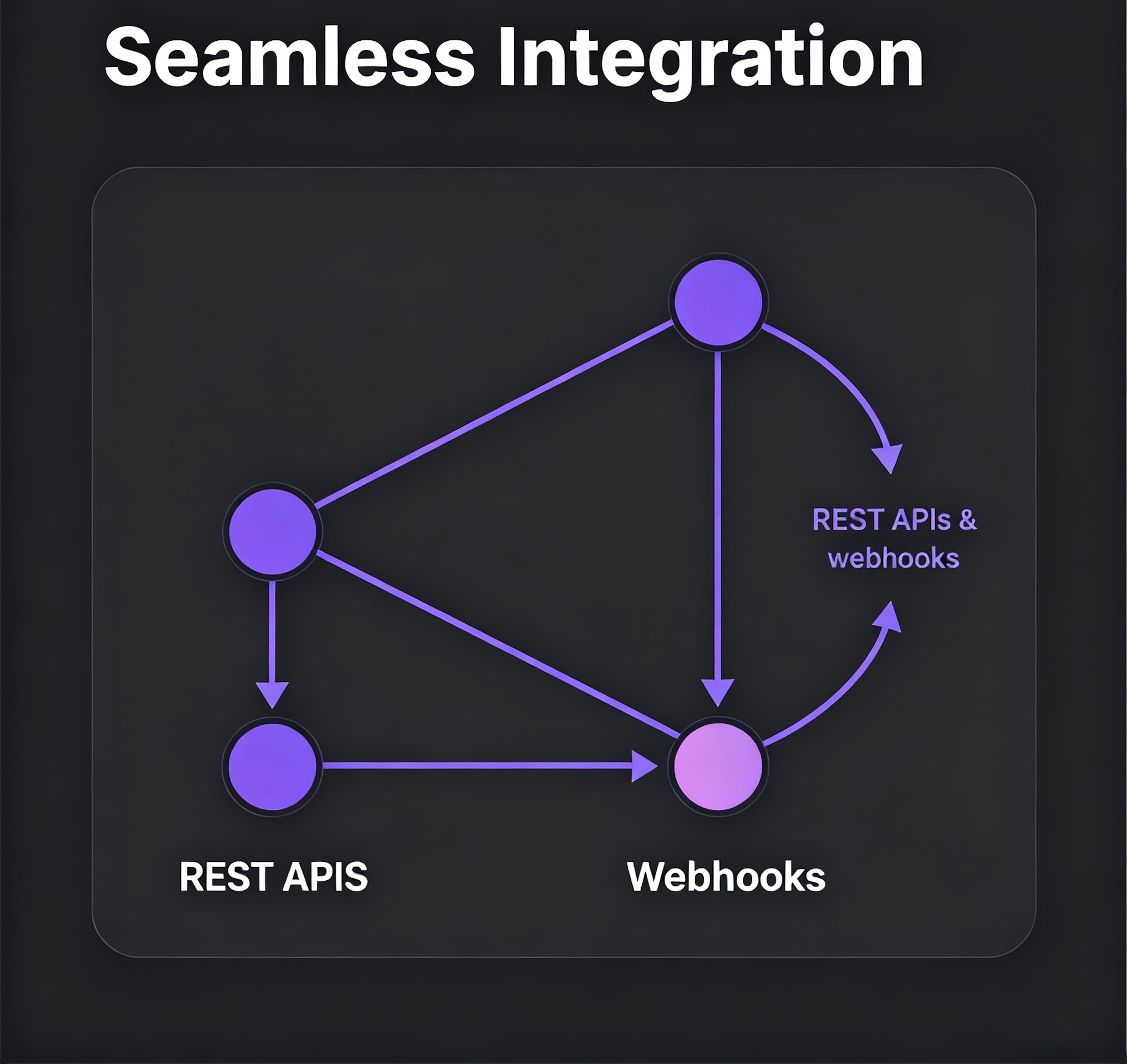

- Seamless Integration via REST APIs & webhooks

- Secure & Compliant — bank-grade security, local regulations

- Flexible Settlement Options — daily, weekly, or custom cycles

Enterprise-Grade Payout Management

Manage payroll disbursements, vendor payments, and in-game credit withdrawals seamlessly with real-time monitoring, automated compliance checks, and flexible settlement cycles.

- Batch Payout Processing for multiple recipients

- Real-Time Transaction Monitoring & Alerts

- Regulatory Compliance & Audit-Ready Reports

Trusted by brands

all over the world

Questions about IDR payouts?

Payout FAQs

What payout methods do you support?

We support IDR payouts via bank transfers and leading e‑wallets across Indonesia. Use cases include payroll disbursements, vendor payments, affiliate commissions, gig worker payouts, and in‑game credit withdrawals.

How fast are payouts processed?

Most payouts are processed in real time or within the same business day, subject to bank/e‑wallet cut‑off times and routine risk checks. Settlement cycles are flexible: daily, weekly, or custom to fit your operation.

Are payouts limited to IDR?

Yes, we specialize in Indonesian Rupiah (IDR) payouts. If you need cross‑border funding or currency conversion, talk to our team to explore available options for your use case.

How is pricing structured?

Transparent, volume‑based pricing with no hidden fees. Fees depend on method (bank vs e‑wallet), monthly volume, and risk profile. Contact Sales for a tailored quote.

What about compliance and security?

We follow strict KYC/AML controls, apply bank‑grade encryption, and adhere to local regulatory requirements. Access is protected via role‑based controls, audit logs, and webhook signing.

How do we integrate?

Integrate via REST APIs with webhook callbacks for status updates. We provide API keys, sandbox credentials, and example payloads. Non‑technical teams can also use the dashboard to upload batch payouts (CSV).

Any minimums, limits, or additional checks?

No strict minimum amount. Per‑transaction and daily limits can apply depending on payout method and verification tier. Large‑value transfers may require additional verification to keep your funds secure.

How do we get support?

Reach us via the contact form or email. Our team typically responds within one business day. Critical incidents are monitored 24/7 with proactive alerts.

Privacy Policy

This Privacy Policy explains how PT HIDUP TEKNO ASIA ("Hiteksia", "we", "us", or "our") collects, uses, discloses, and protects your information when you use our IDR payout services and related websites, dashboards, and APIs.

1. Information We Collect

- Account & Contact Data: name, company, email, phone number, address.

- KYC/AML Data: identity details, government-issued IDs (as legally required), and verification results.

- Transaction Data: payout instructions, recipient details, payment method, amount, currency (IDR), timestamps, and status updates.

- Technical Data: IP address, device/browser info, logs, cookies, diagnostic and performance metrics.

2. How We Use Information

- Provide, operate, and improve IDR payout services and features (including batch payouts and status tracking).

- Verify identity and conduct due diligence/risk assessments (KYC/AML, fraud prevention).

- Process transactions and settlements; provide notifications and webhook updates.

- Comply with legal obligations and respond to lawful requests from authorities.

- Customer support, incident response, analytics, and service improvement.

3. Legal Bases (Where Applicable)

We process personal data based on one or more of the following legal bases: performance of a contract, legal obligations, legitimate interests (e.g., service security and improvement), and consent where required.

4. Sharing & Transfers

- Service Providers supporting payments, KYC/AML, analytics, infrastructure, and customer support under confidentiality and data protection obligations.

- Financial Institutions & Payment Partners (banks and e‑wallets) to execute payouts and settlements.

- Regulators & Law Enforcement when required by law or to protect rights, security, and integrity.

- Business transfers (e.g., merger, acquisition) in compliance with applicable law.

5. Cookies & Tracking

We use cookies and similar technologies to maintain sessions, secure access, remember preferences, and analyze usage. You can control cookies through your browser settings; disabling certain cookies may affect functionality.

6. Data Retention

We retain information for as long as necessary to provide services, comply with legal/financial record‑keeping, resolve disputes, and enforce agreements. Retention periods may vary based on regulation and risk requirements.

7. Security

We implement bank‑grade security controls, including encryption in transit and at rest where appropriate, role‑based access controls, audit logging, and continuous monitoring. No method of transmission or storage is 100% secure; we strive to protect your information using industry best practices.

8. Your Rights

Subject to applicable law, you may request access, correction, deletion, restriction, or portability of your personal data. You may also object to certain processing. To exercise your rights, contact us using the details below.

9. Children’s Data

Our services are not directed to children. We do not knowingly collect personal information from individuals under the age required by applicable law. If you believe a child provided us data, please contact us so we can take appropriate action.

10. Third‑Party Links

Our website may contain links to third‑party sites or services. Their privacy practices are governed by their own policies; we encourage you to review them.

11. Changes to This Policy

We may update this Privacy Policy from time to time. We will post the updated version on this page and revise the effective date. Material changes may be communicated via email or dashboard notices.

12. Contact Us

Company: PT HIDUP TEKNO ASIA (Hiteksia)

Address: Jalan Raden Saleh No. 54, Karang Mulya, Karang Tengah, Tangerang City, Banten, Indonesia

Phone: 087727076841

Email: hidupteknoasia@gmail.com

Effective date: 2025‑09‑09

Terms & Conditions

These Terms & Conditions ("Terms") govern your access to and use of the IDR payout services, dashboard, and APIs provided by PT HIDUP TEKNO ASIA ("Hiteksia", "we", "us", or "our"). By using our Services, you agree to be bound by these Terms.

1. Acceptance of Terms

By accessing or using the Services, you confirm that you have read, understood, and agree to these Terms and our Privacy Policy. If you are using the Services on behalf of an organization, you represent that you have authority to bind that organization to these Terms.

2. Services

- IDR payout processing to bank accounts and leading e‑wallets in Indonesia.

- Dashboard tools for batch uploads (CSV) and real‑time status tracking.

- REST APIs with webhook callbacks for programmatic integrations.

3. Eligibility, Onboarding & KYC/AML

Use of the Services is subject to our onboarding, verification, and ongoing monitoring requirements, including Know‑Your‑Customer (KYC) and Anti‑Money Laundering (AML) checks. You agree to provide accurate, complete, and current information and to promptly update it as needed.

4. Accounts & Security

- You are responsible for maintaining the confidentiality of credentials (API keys, passwords) and for all activities under your account.

- You must implement reasonable security controls in your systems, including secure storage of credentials and webhook signing validation.

5. Fees, Taxes & Billing

Fees are charged per transaction and/or by service tier, as agreed in your commercial terms. Unless stated otherwise, fees are exclusive of applicable taxes. We may invoice or deduct fees from settlement amounts. Late payments may incur interest or lead to suspension.

6. Payout Processing, Cut‑Offs & Settlement

- Processing speeds depend on method (bank vs e‑wallet), partner networks, cut‑off times, and risk checks.

- Settlement cycles can be daily, weekly, or custom as agreed.

- Large‑value or unusual activity may require additional verification and could be delayed or declined to protect you and recipients.

7. Prohibited Activities

You may not use the Services for illegal activity, sanctions violations, fraud, gambling where prohibited, illicit content, or any activity that could harm our partners, recipients, or networks. We may update restricted categories from time to time.

8. Compliance & Audits

You agree to comply with applicable laws and regulations of the Republic of Indonesia and other relevant jurisdictions. Where required, you will cooperate with reasonable information requests and compliance reviews related to your use of the Services.

9. Data Protection

Our handling of personal data is described in the Privacy Policy. You are responsible for providing any required notices and obtaining consents from your customers or recipients where applicable.

10. Intellectual Property

We retain all rights, title, and interest in and to the Services, including software, APIs, documentation, and branding. No rights are granted except as expressly set out in these Terms.

11. Third‑Party Services

The Services may interoperate with third‑party services (e.g., banks, e‑wallets, KYC providers). We are not responsible for third‑party terms or performance; your use of such services may be subject to their terms.

12. Warranties & Disclaimers

To the maximum extent permitted by law, the Services are provided "as is" and "as available" without warranties of any kind, whether express, implied, or statutory, including merchantability, fitness for a particular purpose, and non‑infringement.

13. Limitation of Liability

To the maximum extent permitted by law, neither party will be liable for indirect, incidental, special, consequential, or punitive damages, or for lost profits, revenues, or data. Our aggregate liability under these Terms will not exceed the amounts paid by you to us for the Services in the preceding three (3) months.

14. Indemnification

You agree to defend, indemnify, and hold harmless Hiteksia and its affiliates, officers, employees, and agents from and against claims, damages, liabilities, costs, and expenses arising out of your use of the Services or violation of these Terms.

15. Suspension & Termination

We may suspend or terminate access to the Services for suspected violations of these Terms, fraud, security concerns, non‑payment, or legal obligations. You may terminate by closing your account; accrued obligations and provisions intended to survive will remain in effect.

16. Changes to Terms

We may update these Terms from time to time. Changes take effect upon posting. Your continued use of the Services after changes become effective constitutes acceptance of the updated Terms.

17. Governing Law & Dispute Resolution

These Terms are governed by the laws of the Republic of Indonesia. Any disputes will be resolved through the competent courts in Indonesia unless otherwise agreed in writing.

18. Contact

Company: PT HIDUP TEKNO ASIA (Hiteksia)

Address: Jalan Raden Saleh No. 54, Karang Mulya, Karang Tengah, Tangerang City, Banten, Indonesia

Phone: 087727076841

Email: hidupteknoasia@gmail.com

Effective date: 2025‑09‑09